Remortgaging your home is a move that can unlock substantial savings. However, many homeowners in Ireland overlook this opportunity to save money.

There are many valid reasons why remortgaging could be the right financial move for you. In this article, we’ll cover what remortgaging is, why you should consider it, and how switching mortgages can save you money and improve your finances.

What is a remortgage?

A remortgage is when you replace your existing home mortgage with a new mortgage from a different bank or mortgage lender. So a remortgage is when you take out a new mortgage on better terms which replaces your existing mortgage.

Valid reasons to remortgage

There are many valid reasons why a remortgage can make a lot of sense for you. | You might be able to save money with a better mortgage interest rate | You might need cash for home improvements | You might want to release equity to consolidate expensive short-term loans |. Whatever your reason, it is good to explore if remortgaging your home makes sense for you!

As a mortgage broker in Ireland, I help people every day to save money with lower mortgage rates. From my experience as a Mortgage Broker the following are the main benefits of switching mortgages.

Remortgage to a better interest rate

Sometimes it is necessary to switch mortgage lenders to avail of better mortgage interest rates. A mortgage is a big monthly expense for most of us. It can make an enormous difference to our finances if we can reduce our biggest monthly expense.

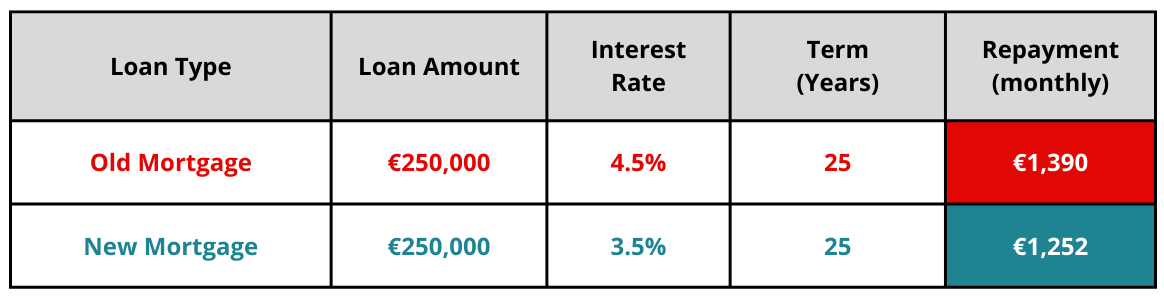

Let’s look at the following example to see how much you can save on your monthly mortgage repayments with a better interest rate.

In this example there is a saving of €1,656 per year. Thats a whopping €41,400 over the remaining term of the mortgage. So now you can see how a better mortgage interest rate can mean big savings for you.

Change in financial circumstances

A mortgage is a long-term commitment and often your life situation can change. Sometimes life does not go as planned and you need to adjust.

Separation or divorce for example can mean that you also need to separate your finances from your ex-partner. One option would be to sell the house. If there is equity in the property then you might sell the house to clear the existing mortgage and then share any surplus funds.

However if one person wants to buy out the other then a remortgage might be needed. In this situation the person buying out the other will take out a new remortgage to clear the existing mortgage. You might also need to raise funds to buy out the other person. This is only an option if one of you qualifies for a larger mortgage to buy out the other.

Access equity in your home

Accessing the equity you have in your home is another valid reason for remortgaging. Over time property prices normally increase and the mortgage balance will reduce. So your equity in the property will increase (equity = property value minus mortgage balance).

Taking out a remortgage will allow you to access the built-up equity in your home. You can release the equity in the form of a cash lump sum — for example, you could consider an equity release mortgage in Ireland to fund life expenses like home improvements, childrens education costs or other big one-off expenses.

A remortgage can help you fund big ticket items like home improvements in an affordable way. You can get a lower interest rate on a mortgage, and you can also spread the repayments over a longer term.

Better and more flexible mortgage terms

You might want to remortgage so you can switch mortgage lenders to avail of better and more flexible mortgage options. Below is an example of the flexible options that are available in Ireland with some (but not all) mortgage lenders.

Make overpayments without fixed rate penalty

This means you can benefit from the security of a fixed mortgage but at the same time have the flexibility to make overpayments with no fixed rate penalties. Making overpayments can significantly reduce the mortgage interest you pay. So, this is a great flexible mortgage feature to have. It is not available with all mortgage lenders.

Split your mortgage rate. Part fixed rate and part variable rate.

Sometimes it can be hard to decide if you want to take a fixed rate or a variable rate. Fixed gives you security whereas variable gives you flexibility to pay off the full mortgage whenever you like without any penalties. The option to be able to split your mortgage rate, part fixed, and part variable is a great option if you need that added flexibility.

Payment breaks for up to 3 months.

Mortgage payment breaks can be great if you need to take time off work or have unexpected one off expenses. Some mortgage lenders automatically allow payment breaks while with others it needs to be approved beforehand.

Pay your mortgage in 11 repayments per year so you can have a month off.

This can be a wonderful way to take a month off mortgage payments. For example you may want to have a month off payments at Christmas or whenever you plan to go on holiday each year. With this option you can make higher mortgage repayments for 11 months and then not have any mortgage payment to make in December for example. You are still paying the full annual mortgage payments each year but with a month off.

Get Cashback on your mortgage deal

Getting cashback on a new mortgage deal, can be a perfectly valid reason to remortgage your house. Cashback deals can more than cover the cost of switching mortgage lenders. When you get a new remortgage there will be legal costs but the cashback deals can make it free to switch mortgage providers.

Mortgage lenders offer cashback deals of up to 3% of your mortgage amount. This means you can get free cashback of up to €7,500 on a mortgage of €250,000. The legal costs to switch to a new remortgage should be no more than €1,500. So, with mortgage cashback offers you will have more than enough to cover your solicitor costs. You might also be able to fund a family holiday or you could put the extra cash into savings for a rainy day.

Reduce the mortgage term

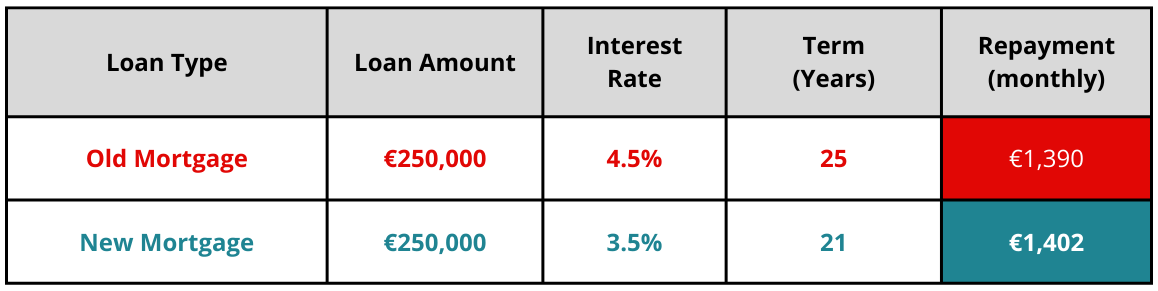

One of the most sought-after benefits of switching mortgages is to reduce the mortgage term (years). If you can get a better remortgage interest rate, then you will have the option to reduce your mortgage term, keep your payments the same and clear your mortgage sooner. Let us consider the following example where you could reduce your mortgage term by 4 years with a new remortgage interest rate that is 1% lower.

So, in this example you would keep your monthly mortgage repayment pretty much the same and you would clear your mortgage 4 years early. You would also save a whopping €63,696 in mortgage interest. Not too shabby!

Loan consolidation

Buying and maintaining a home is expensive and, in some cases, you may end up taking out expensive short-term loans with your bank or credit union.

The loan repayments on top of your monthly mortgage payments can quickly get overwhelming.

One way to improve your cashflow is to use a new remortgage to consolidate your expensive debts into one lower monthly repayment. The new monthly repayment will be lower as you will get a better mortgage interest rate and the repayment term might be longer.

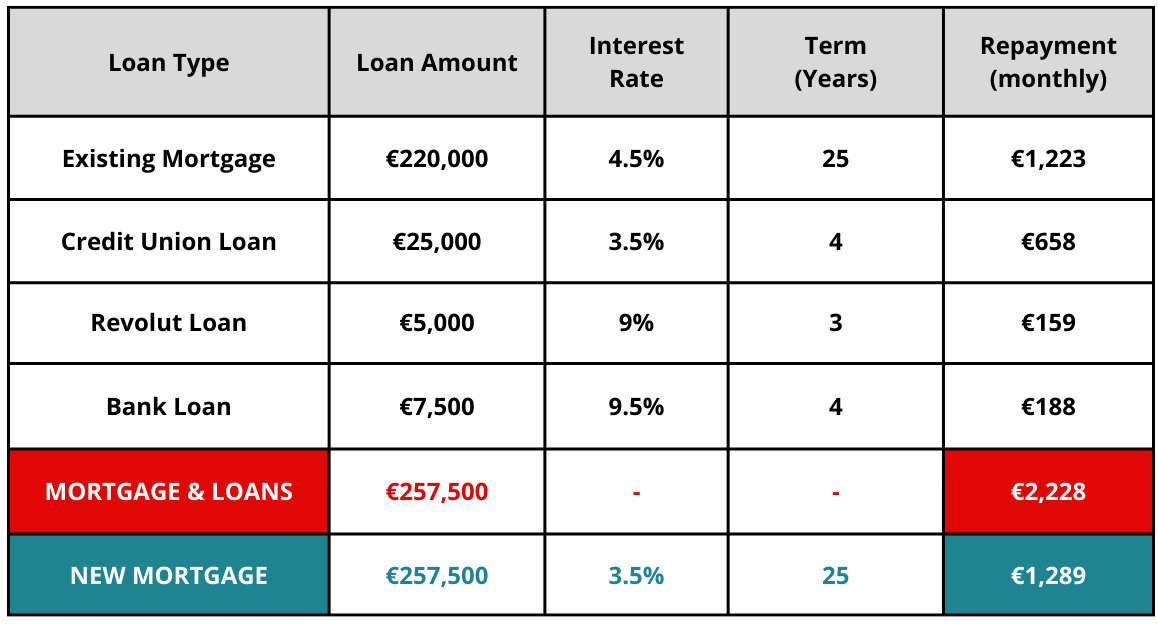

Let us look at the following example of how consolidating expensive short-term debts into a remortgage can improve your monthly cashflow.

So, using this example by consolidating all debt into the new remortgage you could lower total monthly debt repayments by €939.

If you consolidate debt the new loan may take longer to pay off than previous loans. This means you may pay more than if you paid over a shorter term. Ideally, mortgage terms should be as short as possible but also consistent with your ability to repay.

Home improvements

Using a remortgage to raise extra funds for home improvements is another popular reason to remortgage your house. As long as your income allows a higher mortgage amount and there is equity in your home then you can remortgage to fund home improvements.

Why should I remortgage with MortgageLine?

MortgageLine is a market leading Mortgage Broker with a team of experienced Financial Advisers who are ready to help you. We have a 5-Star Rating on Google and Trustpilot and are proud to be a top rated Mortgage Broker helping clients all over Dublin and Ireland. We also provide guidance to help eligible buyers apply for first-time buyer mortgages.

Whatever your reason for remortgaging, MortgageLine understands the importance of making sure you get access to the best possible mortgage interest rates. Our mortgage experts have the knowledge and experience to help you navigate the mortgage market to secure the most competitive mortgage rates and terms.

Request a free no obligation mortgage review with an expert MortgageLine Broker today.

Start the Process. Make the Switch!

If you’re ready to talk about the possibility of a remortgage and experience the benefits for yourself, get in touch with MortgageLine!

Apply online today or Call Us on 01 707 9880