Buying your first home is one of the biggest financial steps you’ll ever take—and for many first-time buyers in Ireland, the most pressing question is: how much deposit do I need to get on the property ladder?

Let’s break it all down, from how much deposit is typically required, to how government schemes can help you reduce the amount you need upfront. We’ll also cover regional differences, real-life examples, and how MortgageLine can help you navigate the home buying process with confidence.

How much deposit for a mortgage first time buyer in Ireland?

In Ireland, the standard deposit required for first-time buyers is 10% of the property’s purchase price, as per the Central Bank of Ireland’s mortgage lending rules. This means if you’re buying a home valued at €300,000, you’ll need to provide a €30,000 deposit. This 10% rule normally only applies to properties under €1 million. For larger mortgages you may need a 20% deposit. However, the rules for larger mortgages vary from bank to bank so check with your mortgage broker first.

All mortgage lenders in Ireland—banks, credit unions, and other financial institutions—must adhere to the Central Bank mortgage rules.

But here’s the good news: there are schemes designed to help reduce the deposit needed to buy a property, especially for first-time buyers purchasing new builds.

Here are a few worth exploring:

- Help to Buy Scheme – This government scheme offers a tax rebate of up to €30,000 or 10% of the property value, whichever is lower, to help fund your deposit on a new build.

- First Home Scheme – This is a shared equity scheme designed to bridge the gap between your mortgage, deposit, and the purchase price.

These government schemes can make a huge difference when saving for your first time buyer deposit in Ireland.

Deposit percentage for first time buyers: the 90% mortgage rule

Irish banks can lend up to 90% of the property’s value to first-time buyers, which means you need to come up with the remaining 10% as a deposit.

Let’s say you’re looking to buy your first home for €300,000. Under the 90% mortgage rule for first-time buyers in Ireland, a bank could lend you up to €270,000. You’d then need to provide the remaining 10%—which in this case would be €30,000—as your deposit.

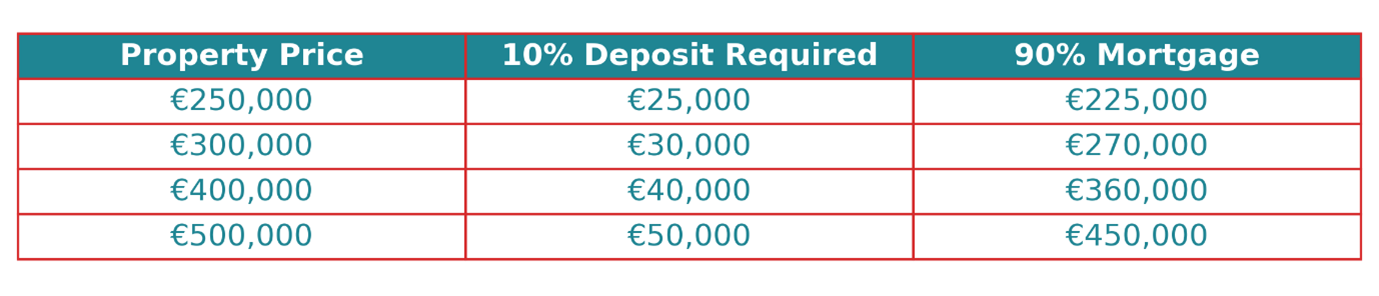

You can see more examples in the table below, showing different property prices and the corresponding deposit and mortgage amounts.

The deposit percentage for first time buyers ensures that buyers have some equity in the home from the outset and that lenders remain cautious with their risk exposure. It’s part of the broader policy to ensure financial stability across the Irish housing and mortgage market.

Average deposit for a house first time buyer in Ireland

So, what is the average deposit needed for first time buyers in Ireland today?

According to data from the Banking & Payments Federation Ireland (BPFI), the average mortgage for a first-time buyer in Ireland in 2024 was around €270,000. This means the average deposit for a first time home buyer would be roughly €27,000.

Of course, this varies greatly depending on location:

- Dublin: With property prices often exceeding €500,000, the deposit needed can rise to €50,000 or a lot more in some parts of the capital.

- Cork, Galway, Limerick: First-time buyers may need deposits of around €25,000–€35,000. However again depending on the property type and location. You might need a higher deposit.

- Smaller towns or rural areas: Deposits may be more affordable, with homes under €250,000 requiring €20,000–€25,000 deposits.

So, when asking how much deposit for first time buyer Ireland, consider where you’re buying!

Additional costs first-time buyers should consider

While your deposit is the most talked-about upfront cost, it’s far from the only one. Buying your first home in Ireland comes with several additional expenses that can catch you off guard if you’re not prepared.

Here are some average additional expenses you should be prepared for:

- Stamp Duty: 1% of the purchase price (for properties up to €1 million)

- Solicitor’s Fees: €1,200 to €2,500 (plus VAT and outlays)

- Surveyor’s Fees: Around €300–€500

- Valuation Fees: Typically, €150–€250

It’s important to budget for these hidden costs of buying a house in Ireland alongside your deposit.

How much deposit do first-time buyers really need?

The short answer: it depends. The amount of deposit required for first-time buyers can vary depending on the type of property you’re purchasing and whether you qualify for government supports like the Help to Buy or First Home Scheme. The amount you’ll need to save upfront isn’t always the same—especially when these schemes come into play.

Let’s break it down with some real-world examples—looking at how your deposit could change based on whether you’re buying a new build or a second-hand home, and whether you’re using any supports available to first-time buyers.

Buyers using Help to Buy vs. those who don’t

- Without Help to Buy: For a €300,000 new build, you’d need the full €30,000 deposit.

- With Help to Buy: You could get up to €30,000 in tax rebates, potentially covering your entire deposit—meaning you may not need to save as much upfront.

Those purchasing second-hand homes vs. new builds

- New builds: Eligible for Help to Buy and First Home Scheme, making them easier for some buyers to afford.

- Second-hand homes: Not eligible for these schemes, so you’ll need to save the full 10% yourself.

How schemes can reduce the effective deposit required

Some buyers using both Help to Buy and the First Home Scheme have secured properties with effectively just a 5% personal contribution or even less. This is where the idea of a “first time buyer 5 percent deposit” often comes from—but it’s not a standalone rule. Rather, it’s the effect of the schemes working together.

How MortgageLine helps first-time buyers through the process

At MortgageLine, we specialise in mortgages for first time buyers in Ireland. Here’s how we make the process easier:

✅ Step-by-step guidance – From getting mortgage ready to moving in, we’re with you every step. Start here: how to get mortgage ready

✅ Access to multiple lenders – We’re not tied to one bank, so we can help you find the best deal based on your circumstances.

✅ Application support – From paperwork to submission, we help you avoid delays and ensure your application is solid.

✅ Expert advice – Unsure about how much deposit you need or how much you can borrow? We’ll help you figure that out. Start with our how much can you borrow for a mortgage tool.

FAQs

Can you get a mortgage with a 5% deposit?

Not on its own. However, with schemes like Help to Buy and the First Home Scheme or a gift from family, some buyers effectively only need 5% out of their own pocket—particularly on new builds.

How small can a house deposit be?

Thanks to government schemes, some buyers have entered the market with as little as 5% saved, but this depends on property type and personal eligibility.

What is the minimum deposit for a first-time buyer mortgage?

The standard is 10% under the Central Bank mortgage rules. However, supports like Help to Buy can offset this, effectively reducing your personal contribution.

Final Thoughts

The first time buyer deposit in Ireland doesn’t have to feel overwhelming. With smart planning, the right support, and help from expert mortgage brokers like MortgageLine, your path to homeownership is absolutely within reach.

👉 Contact us today for a free mortgage review call—and let’s help you get your keys faster!