Cashback mortgages are a popular option in Ireland, offering borrowers a lump sum payment when they take out a mortgage. But are they the right choice for you? In this guide, we’ll break down how cashback mortgages work, highlight the best deals from Irish lenders, and explore the pros and cons so you can make an informed decision.

What is a Cashback Mortgage?

A cashback mortgage is a type of mortgage where the lender provides a cash bonus upon drawdown. This incentive can help cover costs such as legal fees, moving expenses, or home improvements. The amount of cashback varies by lender and is often a percentage of the mortgage amount or a fixed sum.

How Do Cashback Mortgages Work in Ireland?

When you take out a cashback mortgage, your lender will transfer the agreed cashback amount to your account once your mortgage is drawn down. However, these deals often come with conditions, such as higher interest rates or fixed-term contracts.

When Do Borrowers Typically Receive Their Cashback?

Most lenders release cashback within 60 days of mortgage drawdown. Some banks may offer additional cashback if you maintain your mortgage with them for a set period. Always check the terms to ensure you understand the timeline and conditions.

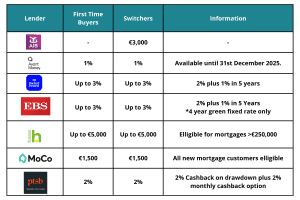

The following are the mortgage lenders that currently provide cashback deals in Ireland:

—Above information correct at 16/02/2025—–

Key Providers Offering Cashback Mortgages in Ireland

Several lenders in Ireland offer cashback mortgage deals. Below is a breakdown of some of the key providers and their cashback offers.

Avant Money Cashback Mortgage

Avant Money is a lender that normally has a focus on offering some of the best mortgage rates however from time to time they also offer cashback deals for Home Buyers and Switchers.

Bank of Ireland Cashback Mortgage

BOI offers up to 3% cashback on mortgages. Normally 2% after drawdown and an additional 1% bonus after 5 years.

EBS Cashback Mortgage

EBS provides cashback on both new mortgages and switcher mortgages, making it a popular choice.

Haven Mortgages Cashback Mortgage

Haven offers competitive cashback deals, particularly for first-time buyers and switchers. They offer a fixed amount which can be dependent on loan size.

MoCo Cashback Mortgage

MoCo offers currently offers a fixed cashback inventive to all new mortgage customers at drawdown.

PTSB Cashback Mortgage

PTSB provides a fixed percentage 2% cashback offer, with additional monthly cash incentives for PTSB Explore current account holders.

(Note: For the latest cashback deals, please refer to the table above which is regularly updated.)

Pros and Cons of Cashback Mortgages

While the idea of receiving extra cash upfront may seem like a great advantage, cashback mortgages also come with certain trade-offs, including potentially higher interest rates or limited lender options.

Understanding the benefits and drawbacks of cashback mortgages is essential for making an informed decision that aligns with your financial goals. In this section, we explore the key advantages and disadvantages to help you determine whether this type of mortgage is the right choice for your situation.

Pros of Cashback Mortgages

- Immediate funds – Helps cover legal fees, stamp duty, or home improvements.

- Useful for first-time buyers – Can make the home-buying process more affordable.

- Available to switchers – Those switching mortgages can benefit from cashback deals.

Cons of Cashback Mortgages

- Higher interest rates – Some cashback deals come with higher mortgage rates.

- Long-term cost – A lower interest rate without cashback may save more over time.

- Conditions apply – Some lenders require you to stay with them for a set period to avail of the full cashback offer.

How to Find the Best Cashback Mortgage Deals

Finding the right cashback mortgage requires comparing interest rates, cashback amounts, and long-term costs. A cashback mortgage broker like MortgageLine can help you evaluate your options and find the best deal tailored to your needs.

MortgageLine Can Help You Find the Mortgage That Suits You Best

At MortgageLine, we specialize in helping homebuyers and switchers navigate cashback mortgage offers. Our team provides expert advice and access to exclusive mortgage deals that may not otherwise be available to you.

Whether you’re a first-time buyer or looking to switch mortgages in Ireland, we ensure you get the best possible deal. Contact us today for a free mortgage review!

FAQs

Is cashback on a mortgage taxable?

No, our understanding is that mortgage cashback is not considered taxable income in Ireland. However it is advisable to confirm with your tax advisor.

How do you get cashback from a mortgage?

Once your mortgage is drawn down, the lender transfers the agreed cashback amount to your account. This normally happens within a month or two of the mortgage drawdown. Some banks require you to maintain your mortgage for a certain period to get the full cashback offer.

What is a mortgage cashback offer?

A mortgage cashback offer is a deal where a lender provides a lump sum payment when you take out a mortgage. The amount and terms vary by lender, so comparing offers is crucial.